Unlock Faster IRS Refunds: 2 Overlooked Details That Can Make A Difference

The Internal Revenue Service (IRS) has made it easier than ever to get your tax refund quickly and efficiently. By following a few simple steps, you can ensure that you receive your refund as soon as possible, in most cases within 21 days of filing your return.

2 Overlooked Details That Can Make a Difference

1. File Electronically

Filing your tax return electronically is the fastest and most accurate way to get your refund. The IRS encourages taxpayers to file electronically because it reduces errors and speeds up the processing time. You can file electronically using tax software, through a tax professional, or on the IRS website.

2. Use Direct Deposit

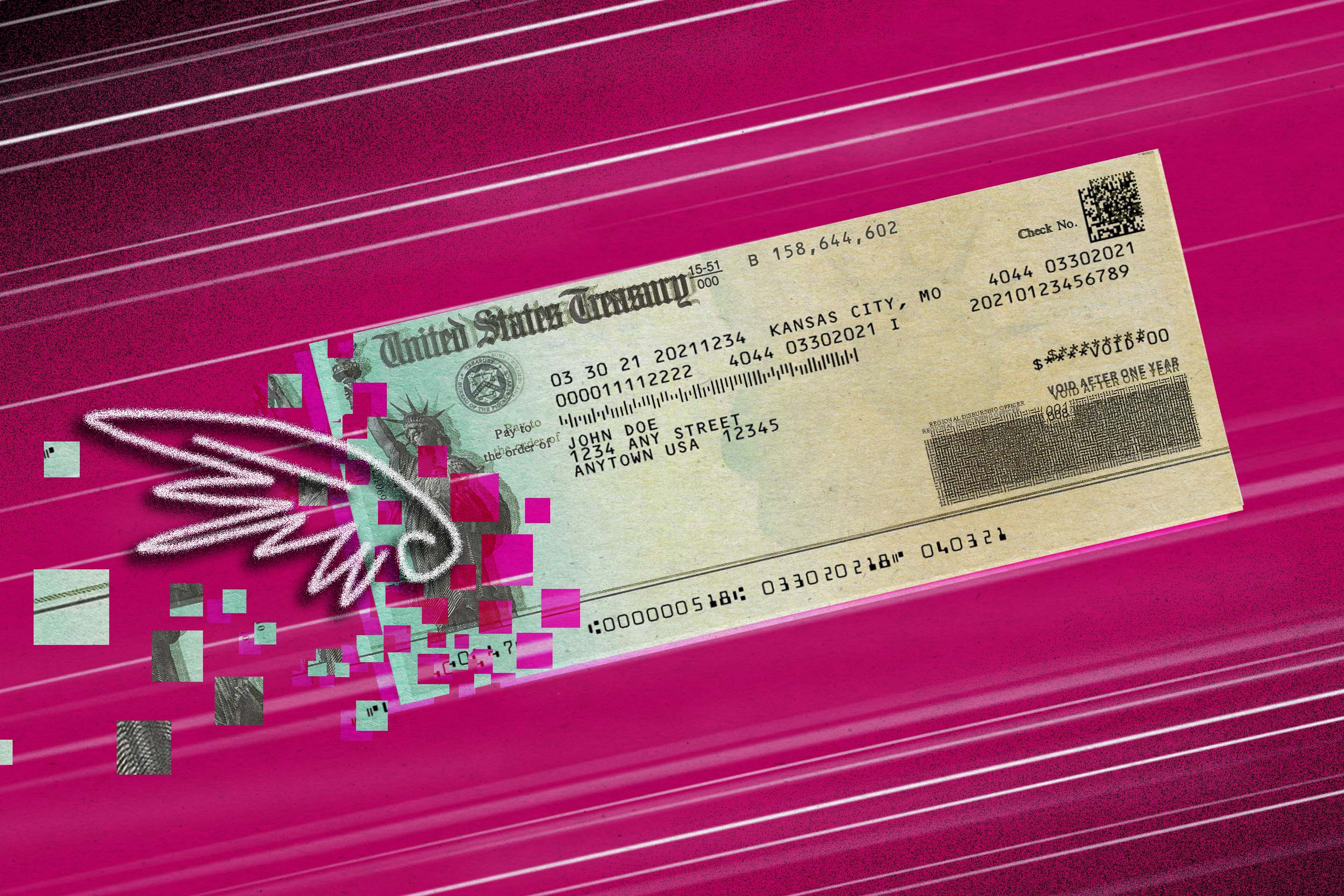

Direct deposit is the fastest way to receive your refund. When you file your tax return electronically, you can choose to have your refund deposited directly into your bank account. This eliminates the need to wait for a paper check to arrive in the mail, which can take several weeks.

Other Tips for Getting Your Refund Faster

In addition to the two overlooked details mentioned above, there are a few other things you can do to speed up the processing of your tax return:

- Make sure your return is complete and accurate.

- Include all necessary documentation, such as W-2s and 1099s.

- File your return as early as possible to allow the IRS ample time to process it.

- Check the status of your refund online or by calling the IRS at 800-829-1040.

Conclusion

Getting your tax refund quickly and efficiently is easy if you follow these simple steps. By filing electronically, using direct deposit, and taking the other steps outlined above, you can ensure that you receive your refund as soon as possible.

Posting Komentar